Renters have nothing to gain from another handout to developers. A tenants’ union is the way forward.

By Joseph Rosen

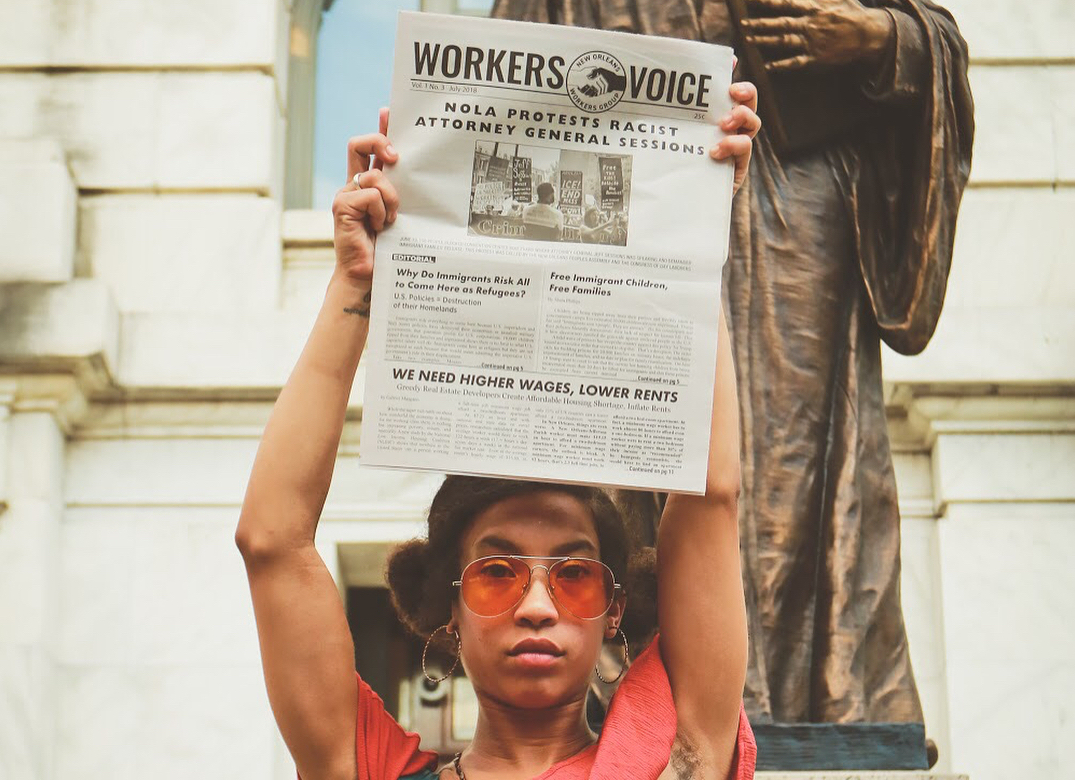

Most households in New Orleans are spending more than half of their income in rent. Across the city, the rate of evictions is on the rise. In response, politicians are selling us ‘solutions’ to the housing crisis that are devised by the very people at the root of the problem. Various schemes to ‘reinvest’ in neighborhoods or to provide ‘affordable housing’ all amount to the same thing: handouts to the rich who are intent on pushing out working class, mainly Black New Orleanians.

One scheme—so called “opportunity zones”—has proven to be an enormous windfall for rich investors and real estate developers. This tax loophole was put into effect as part of Trump’s 2017 tax cuts for the rich. Landlord-in-chief Trump who inherited his real estate fortune from his redlining KKK father designated more than 8,000 census tracts across the country as “opportunity zones,” including 25 in Orleans Parish. These cover the Treme, Gentilly, 7th Ward, Gert Town, Algiers, Central City, Magnolia and more—all areas targeted for gentrification.

By stashing money in so called “Opportunity Zone Funds” rich people can skip out on taxes that would otherwise be applied to the profits that they get from their various enterprises. Workers in New Orleans have to pay a 9.45% tax on the purchase of a hot meal while real estate investors can pay as little as a 0% tax on the purchase of an apartment building—all in order to supposedly “spur investment” in areas “of greatest need.” This giveaway has resulted in a massive land grab. Real estate holdings have been consolidated into the hands of fewer and fewer landlords. The New Orleans Redevelopment Fund is an “opportunity zone” tax shelter worth $30,000,000.

Vote no to Constitutional Amendment 4

Big property developers have devised yet another scheme deceptively claiming it will help with affordable housing. An amendment to the Louisiana state constitution would give the city the authority to waive property taxes for investments in “affordable housing” units, exempting properties up to 15 residential units. This amendment does not even specify how the term “affordable housing” would be applied. The city is already rewarding developers of high-end condos with millions in tax exemptions for making as few as 1 out of every 20 units “affordable housing.” Worse, this giveaway increases gentrification by raising rents in the neighborhoods where these expensive new condos are built, forcing more workers out.

To live, workers need to be paid more. To make higher profits, bosses need to pay less. The bosses have the money, the workers have the numbers. The solution makes itself apparent. The same applies to renters. Renters need a real tenants’ movement that can organize for rent control, tenants’ rights and an end to mass evictions.