by Dylan Borne

“I am a 60 year old mom and I work as a janitor to help my son pay his student loans. I have arthritis which makes my job even harder.”

A woman named Darlene posted this on studentdebtcrisis.org. She’s one of the 44 million Americans carrying crushing student debt. In the past decade, student debt rose to the highest it’s ever been. Now more than $1.4 trillion, it has overtaken auto loan, home equity, and even credit card debt. The average student graduates from college with $35,000 to repay—and counting. In just three years, between 2010 and 2013, the number of “seriously delinquent” loans (loans too high to repay) doubled. Many indebted workers are college dropouts, pressured to go to college by the competitive economy but ending up even worse off than if they had never gone to school.

But lenders and college administrators are laughing their way to the bank. More loans mean more people paying for college, so colleges take advantage and raise tuition. High tuition means more students take out more loans. The cycle continues, stacking up to a debt mountain nearly the size of Texas’s economy.

Yet real wages and salaries are declining. The value of a college degree now is less than half its value than in the early 2000s, according to the Pew Research Center. Students will have to stop paying; the tower of debt will have to fall.

When this happens, the banks won’t suffer. Whether there’s a Republican or a Democrat in office, the government will bail them out like both Bush and Obama did during the mortgage crisis.

But a solution is possible.

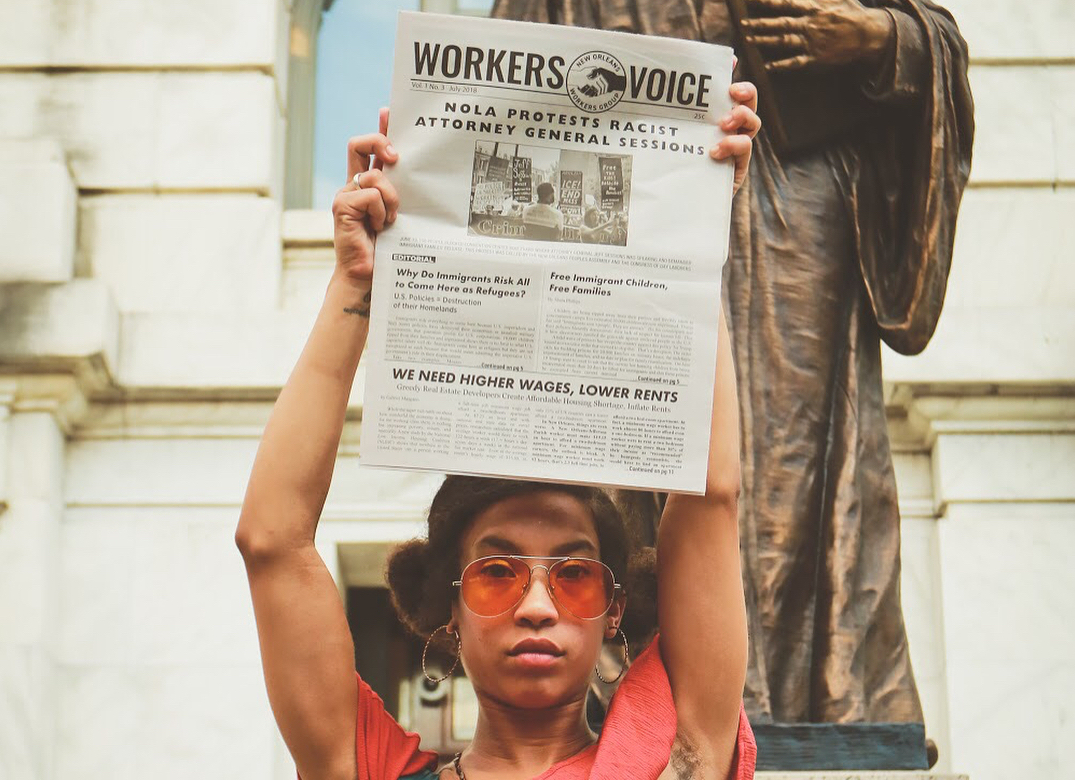

The New Orleans Workers Group demands that the government bail out the people instead of the banks. Cancel student debt. The billionaire bankers can afford to downsize the mansions we bought for them with our interest payments.

College should be free for everyone—like it is in socialist countries like Cuba—so the student debt can’t be amassed in the first place. Banks should be replaced by People’s Banks, overseen by ordinary workers to give out low-interest loans based on helping people sustainably pay for what they need, instead of exploiting them for the bankers’ profit.