By Jennifer Lin

Workers’ pensions are under attack in the U.S. In 2014, the Obama administration proposed and Congress passed a new pension law that allows multi-employer pension plans (for example, trucking and construction) to cut pensions for current retirees.

Years ago, pension funds were put in a guaranteed account with the Pension Benefit Guaranty Corporation, a federal program ensuring that funds did not go bankrupt. Now employers put pension funds in 401K funds controlled by Wall Street speculators. These speculators profit from investments they make using pensioners’ money, but when the stocks fall, pensioners lose money.

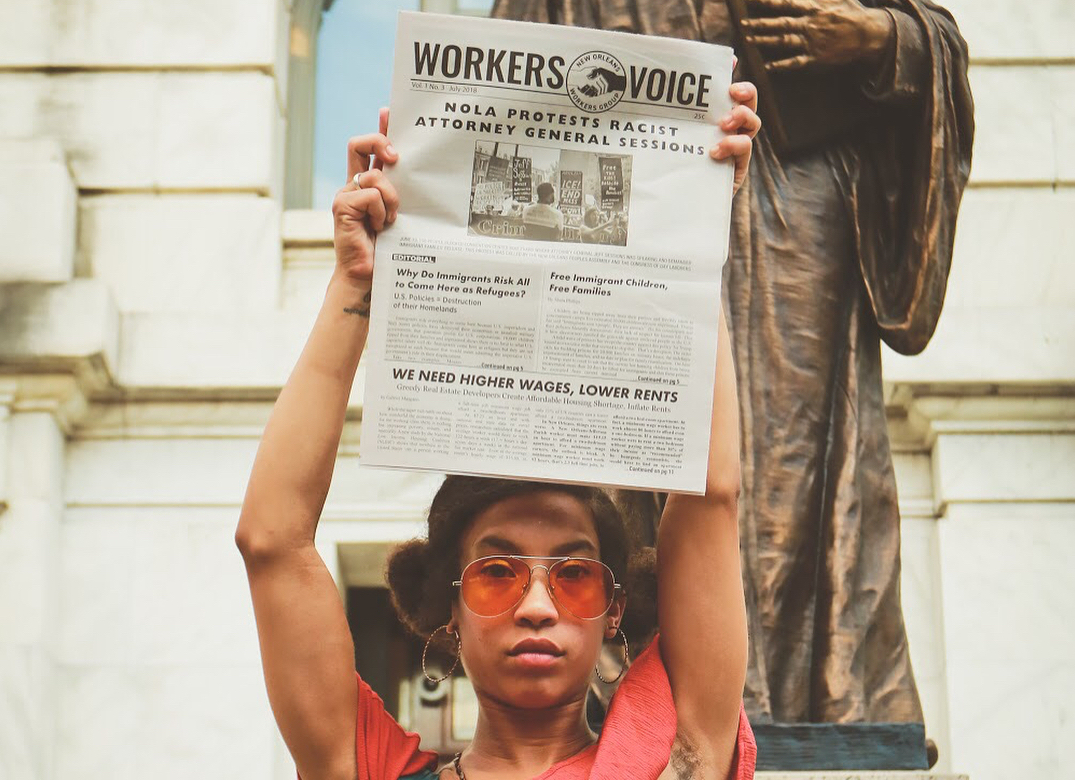

Like the workers in France, we must take to the streets and demand an end to these attacks.

The 2014 pension law allows plan trustees to cut benefits for retirees in order to save the funds they manage from bankruptcy instead of requiring the PBGC to take them over. This ensures that bailout funds are reserved for Wall Street, not workers. Under the new law, 150-200 multi-employer plans covering 1.5 million workers will be drained over the next decade. Retirees, widows, and widowers and domestic partners whose benefits are reduced are banned from filing a lawsuit to challenge the legality of these reductions.

Due to low wages, less job security, and insurmountable debt burdens, workers in the U.S. are retiring later and later in life, only to face declining retirement incomes. In 2017, the median income of retirees age 65 or older was just $19,352.

On top of this Trump & Co. are threatening social security. All this proves that the U.S. government serves Wall Street financiers, not workers. In France, millions of workers and family members have shut down the country to defend their pension laws. Like the workers in France, we must take to the streets and demand an end to these attacks.